- Our customers have been hired by : *Foot Note

Credit officers play a crucial role in financial operations, helping businesses manage risk, assess creditworthiness, and maintain strong cash flow. From reviewing loan applications to setting credit limits and chasing overdue accounts, credit officers help protect a company’s financial health while supporting customer relationships.

This guide gives you everything you need to build a strong credit officer CV, including:

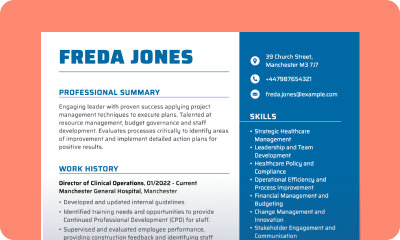

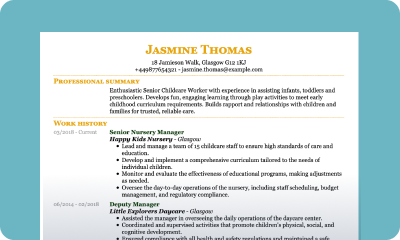

- Real CV examples for credit officer roles

- Professionally designed CV templates

- Step-by-step guidance on how to structure your CV

- Practical CV writing tips to help you stand out

- Common mistakes to avoid

- Frequently asked questions about writing a credit officer CV

SEARCH ALL CV EXAMPLES

Credit officer CV sample

Samantha James

Address: 4 Bold Street, Liverpool L1 4JG

Phone: 07912345678

Email: samantha.j@example-example.co.uk

PROFESSIONAL SUMMARY

Hardworking Credit Officer well-versed in reviewing financial documents, preparing loan packages and making recommendations based on risk values. Detail-oriented and thorough with excellent judgment and good verbal and written communication strengths.

WORK HISTORY

Credit Officer

10/2018 to Current

Central Liverpool Credit Union – Liverpool

- Provided customised credit solutions for families and small business owners, managing loan portfolio exceeding £200,000.

- Facilitated decision-making by educating clients on loan products available, describing complex terms in easy-to-understand language to ensure comprehension.

- Controlled credit risk by analysing portfolio and identifying potential issues impacting client security.

Credit Officer

02/2016 to 10/2018

Fair Finance – Liverpool

- Oversaw and coordinated application process of 200+ loan closings from enquiry to completion.

- Grew existing client relationships through regular updates and engagement, boosting retention by 25%.

- Analysed credit reports and reviewed financial histories to make accurate loan determinations.

Credit Administrator

01/2012 to 02/2016

Loans4You – Liverpool

- Assessed customer compliance with repayment schedules through thorough account reviews.

- Informed new customers on up-to-date credit terms and conditions.

- Issued official approval and rejection notices within allowable limits and in line with institutional risk profiles.

SKILLS

- Loan documentation

- Credit management processes

- Creditworthiness assessments

- Financial risk minimisation

- Personal loans expertise

- Financial statement analysis

EDUCATION

GCSEs: 2007

Formby High School

The best format for your credit officer CV

As a credit officer, your CV should reflect professionalism, attention to detail, and a sound understanding of financial processes. Whether you’re applying to a commercial lender, a finance department, or a banking institution, the layout and structure of your CV should support clarity, accuracy, and ease of navigation.

Here are some general formatting tips:

- Use a clean, professional font such as Arial or Calibri to present a sharp and readable document

- Maintain consistent spacing and wide margins to ensure your CV looks organised and uncluttered

- Clearly display your contact information and relevant certifications (e.g. CICM membership) at the top

- Use bullet points to break down responsibilities and highlight achievements under each role

- Where possible, include metrics (e.g. improved collection rates or reduced debtor days) to show tangible impact

When deciding on the best CV format, consider your experience level and how best to showcase your strengths. Below are two formats commonly used in finance and credit control roles:

Chronological CV

A chronological CV is ideal if you have solid experience in credit control, finance, or related roles. It puts your most recent position first and allows you to show progression within financial teams. This format makes it easy for employers to see your work history, the sectors you’ve worked in (e.g. retail, manufacturing, B2B), and your growing responsibilities in assessing credit risk or managing aged debt.

Skills-based CV

A skills-based CV, or functional CV, is a good choice if you’re new to credit control, transitioning from another finance role, or returning to work after a break. It focuses on your core skills rather than job titles. This format works well when you want to highlight transferable skills and show potential, even without an extensive work history.

How to write an effective CV for a credit officer

As a credit officer, your CV should reflect your accuracy, reliability, and understanding of financial risk. Employers look for clearly structured information that demonstrates your ability to manage credit limits, recover debt, and support business cash flow.

Below, we’ll guide you through each key section of the CV, from your personal profile to your financial experience.

- Contact details first

- Writing your credit officer CV’s personal statement

- Adding an experience section to your credit officer CV

- How to write the skills section of your credit officer CV

- Outlining education on a credit officer CV

Contact details first

Begin your CV with your contact information clearly presented at the top. Include your full name, current location (town or city), a professional email address, and a reliable mobile number. You may also wish to add your LinkedIn profile if it reflects your professional experience in finance or credit control.

Example contact section

Brett Hawkins

53 Church Way

Sheffield S1 9TH

07912 345678

brett.h@example.co.uk

Writing your credit officer CV’s personal statement

Your personal statement is your first opportunity to make a strong impression. It should clearly summarise your key strengths, relevant experience, and what makes you a strong fit for the role. This short section at the top of your CV, around three to four sentences, should focus on your financial expertise, achievements in credit control, and ability to support business performance.

Avoid simply repeating your job history. Instead, highlight your core strengths and the value you bring to an organisation.

Example personal statement for a credit officer CV

Reliable and results-driven credit officer with over six years of experience in credit control and risk assessment within manufacturing and commercial sectors. Skilled in managing large ledgers, reducing aged debt, and improving collection processes. Adept at negotiating payment terms, resolving disputes, and working cross-functionally with sales and finance teams. Committed to maintaining strong client relationships while ensuring healthy cash flow and compliance with credit policies.

Adding an experience section to your credit officer CV

In credit control, your track record of managing accounts, mitigating risk, and maintaining cash flow is central to your value as a candidate. The experience section of your CV should do more than list job titles – it should clearly demonstrate how you’ve delivered results and supported financial operations.

List your roles in reverse chronological order, starting with the most recent. Aim to include two to three previous positions, especially if they show progression or variety across industries. Use clear, professional language and focus on your impact in each role.

Be sure to include:

- Job title, company name, and employment dates

- A concise overview of your responsibilities

- Any systems or software used (e.g. SAP, Sage, Excel)

Measurable outcomes such as debt reduction or improved collection rates - Evidence of collaboration with finance, legal, or sales teams

Example of work experience for a credit officer

Credit Officer

Lloyds Banking Group, Birmingham

June 2020 – Present

Assess and process around 40 personal and business credit applications per week, ensuring regulatory and internal compliance

Perform credit risk evaluations and liaise with underwriters to support informed lending decisions

Monitor active accounts, identifying risk early and reducing overdue balances by 15%

Maintain accurate client records in line with GDPR, and contribute to regular audit preparation

How to write the skills section of your credit officer CV

The skills section of your CV is your chance to quickly show employers that you have the right mix of knowledge and abilities for the role. It should highlight both technical skills (such as financial software or credit risk analysis) and soft skills (like communication or time management) to give a well-rounded picture of your capability.

Include 8 to 10 skills in total and use bullet points to keep the layout clean and easy to read. Aim for short, clear phrases that a hiring manager or applicant tracking system (ATS) can pick up at a glance.

Be sure to include:

- Technical skills like debt recovery, account reconciliation, or using Sage or SAP

- Soft skills such as negotiation, attention to detail, or teamwork

- Any sector-specific experience, such as working with trade credit, B2B clients, or financial reporting

Technical skills for a credit officer

- Credit risk assessment

- Aged debt management

- Use of accounting software (e.g. Sage, SAP, QuickBooks)

- Financial reporting and reconciliations

- Payment term negotiation

- Familiarity with credit legislation and data protection regulations

General skills to include

- Communication and negotiation

- Time management

- Attention to detail

- Organisation and prioritisation

- Conflict resolution

- Team collaboration

Outlining education on a credit officer CV

For most credit officer roles in the UK, a degree is typically expected, especially in fields like finance, accounting, economics, or business administration. The education section of your CV should clearly highlight your qualifications and any specialist training that demonstrates your suitability for the role.

Start by listing your most recent or highest qualification. In addition to your degree, include any relevant professional certifications, such as credit management courses, finance-related modules, or training in software like Excel. These certifications will show that you not only have the necessary subject knowledge but are also committed to ongoing professional development.

Make sure to include:

- The name of your qualification

- The institution where you studied

- Dates of attendance or graduation

- Any relevant modules, honours, or distinctions

Example of education for a credit officer CV

BA (Hons) Accounting and Finance

University of Manchester | 2017 – 2020

Certificate in Credit Management (Level 2)

Chartered Institute of Credit Management | Completed 2022

Dos and don’ts for your credit officer CV

Not all credit officer jobs are the same. Some focus on commercial lending, others on consumer finance, collections, or risk assessment. Review the job advert carefully and highlight the experience, tools, and sectors that match the role, such as credit scoring systems, collections processes, or knowledge of FCA regulations.

Use numbers to demonstrate the value you’ve added. For example:

- “Reduced overdue accounts by 30% in Q2 through targeted collection strategies”

- “Managed a £1.5 million credit portfolio with less than 2% delinquency”

Quantifying your achievements helps employers understand your impact.

If you’ve worked in specific sectors (e.g. automotive finance, construction, B2B services), mention it. Credit management can vary by industry, and some roles require sector familiarity.

Keep your CV to two pages maximum. Long, unfocused CVs are harder to read and may lead recruiters to skip key details. Prioritise the most relevant and recent experience.

Your credit officer CV questions answered

How can I improve my chances of getting an interview?

To improve your chances of landing an interview as a credit officer, consider the following:

- Tailor your CV to the specific role by incorporating key phrases and responsibilities mentioned in the job description (e.g., “managing credit assessments” or “monitoring customer payment trends”).

- Show measurable impact by mentioning specific results like “reduced loan defaults by 10%” or “improved credit report turnaround time by 15%.

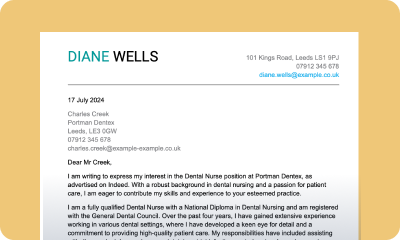

- Include a tailored cover letter: A well-written cover letter can make a big difference. It should show that you’ve researched the company and understand their credit policies and business model. Use it to highlight how your experience and skills align with their needs and show your enthusiasm for the role.

Should I include certifications on my credit officer CV?

Relevant certifications can strengthen your CV and demonstrate your commitment to professional growth. Consider adding:

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- ACCA (Association of Chartered Certified Accountants)

- Credit Risk Management certification

Including these shows potential employers that you’re serious about your professional development and have the technical knowledge required for the role.

What’s the best way to structure my credit officer CV?

A well-structured CV ensures that employers can quickly spot your qualifications and experience. Here’s a recommended structure:

Contact Details Professional Summary (2–3 sentences summarising your skills and experience) Key Skills (technical and soft skills) Work Experience (in reverse chronological order) Education & Certifications (degrees, certifications, relevant courses) Additional Information (languages, volunteer work, etc., if relevant)

Should I include a photo in my credit officer CV?

In the UK, photos are generally not required for professional CVs. It’s best to focus on your qualifications, experience, and skills. Including a photo may distract from the content, especially when applying through applicant tracking systems (ATS). If you’re unsure, check the job description, as some employers may specifically request a photo, but this is rare.

How far back should I go with my work experience?

Generally, for a credit officer CV, you should focus on the last 10 to 15 years of your career. Highlight your most relevant positions, especially those that directly relate to the credit industry, financial analysis, and client management.

If you have more than one role within this period, prioritise those that are most relevant to the job you’re applying for. You don’t need to include every job you’ve had; focus on quality over quantity.

Related Banking CV: Examples, Templates, and Samples for 2026

Create your new CV for a great first impression

Ready to make a strong impression? Use our online CV builder to craft a professional CV that stands out. Choose from a range of polished templates to showcase your career details effectively. Simply add your work and academic history using our pre-written content for easy customisation. Once complete, download your ATS-friendly CV in just a few clicks.

*The names and logos of the companies referred to above are all trademarks of their respective holders. Unless specifically stated otherwise, such references are not intended to imply any affiliation or association with myperfectCV.